Paying off debt feels like climbing a mountain. You know where you want to go, but the path seems endless and exhausting. Without a clear map, it is easy to get lost.

Tracking how to track your debt payoff progress changes everything about your journey. It turns that overwhelming mountain into manageable steps you can actually see yourself conquering.

When you can see real numbers dropping and balances shrinking, something clicks in your brain. Suddenly, you’re not just hoping things get better; you’re watching them improve right in front of you.

Table Of Contents:

- The Best Methods to Track Your Debt Payoff Progress

- Choosing the Right Debt Payoff Strategy to Track

- Setting Up Your Tracking System

- What Numbers to Track Besides Balance

- Making Your Progress Visual and Motivating

- Dealing with Setbacks in Your Tracking

- Using Technology to Automate Your Tracking

- Tracking Progress with Multiple Debt Types

- Maintaining Your Tracking Habit Long-Term

- Learning from Your Tracking Data

- Conclusion

Here’s the thing about debt: it’s sneaky. You make payments every month, but it doesn’t always feel like you’re getting anywhere.

That’s because most of us never actually look at the numbers in a way that makes sense. We just send money into the void and cross our fingers.

But when you start tracking how to track your debt payoff progress, you create accountability. You see exactly where every dollar goes and how much closer you are to debt relief.

We need to see results to stay motivated to eliminate financial stress. Without tracking, you’re flying blind and hoping for the best.

Seeing the reduction in your credit card debt creates a psychological boost. It transforms a vague obligation into a specific mission.

The Best Methods to Track Your Debt Payoff Progress

You don’t need fancy software or a degree in accounting. You just need a system that works for you.

Some people love spreadsheets. Others prefer apps on their phones that do the math automatically.

The method doesn’t matter as much as actually doing it consistently. Pick something you’ll actually use, not something that sits forgotten after a week.

Simple Spreadsheet Tracking

A basic spreadsheet is one of the easiest ways to start. You can create columns for each debt, the balance, interest rate, and monthly payment.

Update it every time you make a payment. Watch those balances shrink month after month.

Google Sheets works great because you can access it from anywhere. No special software needed, just a free account.

You can customize columns to include repayment strategies, notes, or due dates. This flexibility makes it a favorite for those who want total control.

Debt Tracking Apps That Do The Work For You

If spreadsheets aren’t your thing, apps can make tracking almost effortless. Undebt.it is a free tool that helps you plan your payoff plan strategy using different methods.

The Debt Payoff Planner app works on both iPhone and Android devices. It lets you customize your repayment plan based on your specific financial situation.

For something more advanced, Bright Money uses AI to analyze your spending patterns. It can even automate payments to help you pay down high-interest debt faster.

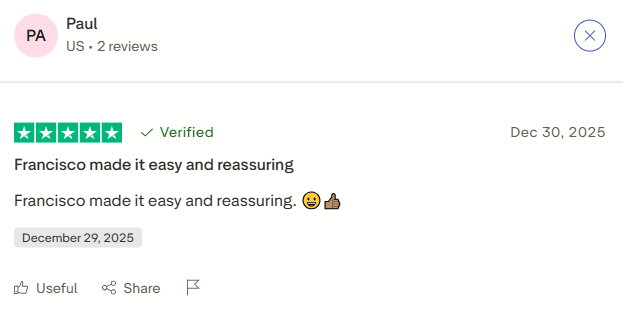

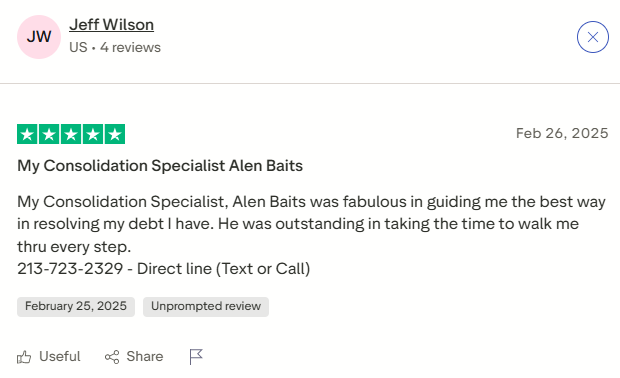

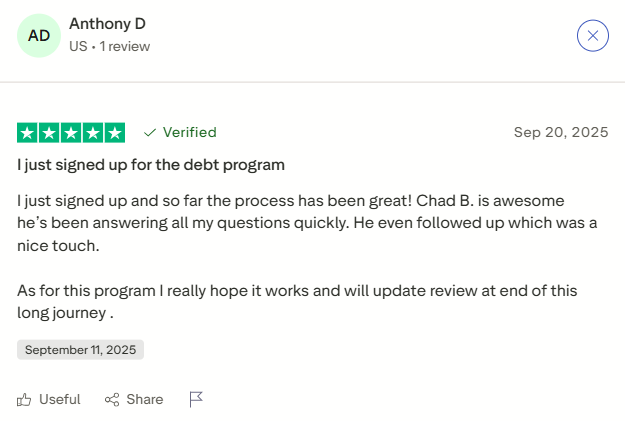

Many debt trackers come with extra features like notifications or credit monitoring. Check the star rating and reviews to find one that users trust.

The Old-School Notebook Method

Don’t underestimate the power of pen and paper. Some people find that writing things down by hand makes the progress feel more real.

Create a simple chart with your debts listed and update it monthly. There’s something satisfying about physically crossing off numbers as they decrease.

Plus, you can’t accidentally delete a notebook like you might a file on your computer. You can use a highlighter to mark off paid milestones, which offers great payoff visualization.

Choosing the Right Debt Payoff Strategy to Track

Before you can track progress effectively, you need a clear strategy. Two popular methods dominate the debt payoff world: snowball and avalanche.

The snowball method focuses on paying off your smallest debt first. Once that’s gone, you roll that payment into the next smallest debt.

The avalanche method targets rate debt first. This saves you more money in interest over time.

Both work, but they feel different psychologically. The Debt Snowball Calculator from Ramsey Solutions can help you map out the debt snowball method approach for free.

Pick whichever method keeps you motivated. Save money matters, but staying consistent matters more.

The table below compares these two popular strategies to help you decide.

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Method Focuses On | Smallest debt balances first | Highest rate interest debts first |

| Psychological Benefit | Quick wins to build momentum | Satisfaction of paying less interest |

| Financial Benefit | Often costs more in interest over time | Helps create faster freedom and saves money |

| Best For | People needing motivation | People driven by math and efficiency |

Setting Up Your Tracking System

Let’s get practical about how to actually set this up. You’ll need to gather some basic information first.

Make a list of every debt you owe. Include credit cards, personal loans, student loans, car payments, everything.

For each debt, write down the current balance, interest rate, minimum payment, and due date. This is your starting point.

Do not leave out any liabilities, such as auto loans or medical bills. You need a complete picture to form a successful debt payoff plan.

Creating Your Baseline Numbers

Your baseline is where you are right now. Don’t judge it; just write it down honestly.

Add up all your debt balances to get your total debt number. This might feel scary, but it’s also clarifying.

Calculate your total minimum monthly payments across all debts. This tells you the bare minimum you need to pay to stay current.

Understanding your total credit card balance and other liabilities allows you to measure debt reduction accurately. You cannot fix what you do not measure.

Deciding How Often to Update Your Tracker

Monthly updates work best for most people. That’s often enough to see progress without becoming obsessive.

Set a recurring reminder on your phone or calendar. Pick a day that works with your budget cycle.

Some people prefer weekly check-ins if they’re making extra payments frequently. Choose what fits your rhythm.

What Numbers to Track Besides Balance

Your debt balance is important, but it’s not the only metric that matters. Tracking multiple data points gives you a fuller picture.

Interest paid each month shows you how much money is going toward the actual debt versus just fees. This number should decrease over time as your balances drop.

Your debt-to-income ratio matters too. Lenders look at this when you apply for credit.

Tracking Your Payoff Timeline

How many months until you’re debt-free? This number changes as you make progress, and watching it shrink is incredibly motivating.

Most debt tracking tools calculate this automatically based on your payment amounts. If you’re using a spreadsheet, you can create a simple formula to project it.

When you make extra payments, update your timeline. Seeing that finish line move closer makes the sacrifices worth it.

Establishing clear payoff dates helps you plan for life after debt. It transforms “someday” into a specific target date.

Monitoring Your Credit Score Progress

As you pay down debt, your credit score often improves. This is another win worth tracking.

Many credit card companies now offer free credit score monitoring. Check yours monthly to see the impact of your hard work.

A rising credit score opens doors to better interest rates and financial opportunities down the road. It reflects your positive payment history and responsible management.

Making Your Progress Visual and Motivating

Numbers on a screen or paper are great, but visual representations hit differently. They tap into a different part of your brain.

Create a chart or graph showing your debt declining over time. Even a simple line going down feels satisfying.

Some people use thermometer-style charts they can color in as they pay off debt. Hang it somewhere you’ll see it daily.

The visual reminder keeps your goal front and center. It’s harder to make impulse purchases when you’re staring at your progress chart.

You can even print out a physical chart and use a checkbox label to mark off every $100 paid. Seeing those checks accumulate helps build momentum.

Celebrating Milestones Along The Way

Don’t wait until all your debt is gone to celebrate. Break it into chunks and reward yourself at each milestone.

Paid off your first credit card? That deserves recognition, even if you still have more to go.

Hit the halfway point on your total debt? Celebrate that win.

Keep the rewards modest and debt-free. A nice dinner at home or a movie night works better than an expensive splurge that sets you back.

Dealing with Setbacks in Your Tracking

Life happens. Sometimes you’ll have a month where you can’t make extra payments or even miss your target.

Don’t let one bad month derail your entire plan. Just acknowledge it, adjust, and keep going.

Your tracker will show the setback, but it will also show all the progress you made before. One stumble doesn’t erase months of hard work.

Update your numbers honestly and recalculate your timeline if needed. Then refocus on the next payment.

If you ignore the problem, the balance risks growing larger due to interest. Facing it immediately is the only way to stop the slide.

Adjusting Your Plan When Income Changes

Job loss, pay cuts, or unexpected expenses can force you to revise your payoff strategies. That’s okay and completely normal.

Go back to minimum payments if you need to. Staying current on all debts protects your credit and prevents late fees.

When your income stabilizes or increases, you can ramp up your extra payments again. Your tracking system will show exactly where to restart.

Finding extra funds might require reviewing other expenses. Check if you can get cheaper auto insurance or bundle policies to save cash.

Using Technology to Automate Your Tracking

The less manual work involved, the more likely you’ll stick with tracking. Automation is your friend here.

Many banking apps now connect directly to debt payoff planner tools. They pull your current balances automatically so you don’t have to enter them manually.

Set up automatic payments for at least your minimums. This prevents missed payments and keeps your tracking data clean.

Just remember to check your automated systems regularly. Technology glitches happen, and you want to catch any errors quickly.

Linking Your Accounts Safely

When connecting financial accounts to apps, make sure you’re using reputable services. Check their data security measures.

Look for apps that use bank-level encryption. Your financial data deserves the highest level of protection.

Never share your actual banking passwords with third-party apps. Use official integrations that follow secure authentication protocols.

Tracking Progress with Multiple Debt Types

Not all debt is created equal. Credit cards, student loans, and mortgages all behave differently.

Your tracking system should account for these differences. Card balance numbers fluctuate more than installment loans.

Group your debts by type in your tracker. This helps you see patterns and prioritize effectively.

High-interest credit card debt might require aggressive extra payments while you maintain minimums on low-interest student loans. Your tracking should reflect these strategic decisions.

Consider private student loans which often have higher rates than federal ones. These should be tracked separately to ensure they are prioritized correctly.

Handling Revolving Credit Carefully

Credit cards are tricky because new charges can offset your payments. Track both your payments and any new spending separately.

Your goal is to see the balance trend downward over time. If it’s not, you’re adding debt faster than you’re paying it off.

Consider freezing the cards you’re paying off to prevent new charges. This makes your tracking numbers cleaner and more motivating.

Sometimes, debt consolidation or a personal loan can help combine revolving debt. This turns variable payments into a fixed monthly payment.

Maintaining Your Tracking Habit Long-Term

The first few months of tracking feel exciting. Everything is new, and you’re seeing progress quickly.

But what happens at month eight when the novelty wears off? This is where most people fall off.

Build tracking into your existing routines. Do it right after you pay bills or during your monthly budget review.

Keep your tracker visible. If it’s an app, put it on your home screen. If it’s a spreadsheet, bookmark it.

The habit becomes easier over time, especially as you start to see real momentum. Missing a tracking session will eventually feel weird.

If you fall off the wagon, don’t worry. Just review your upcoming payments and get back on track immediately.

Learning from Your Tracking Data

All this data you’re collecting tells a story. Are you paying off debt faster than you thought, or slower?

Look for patterns in months where you made extra progress. What was different about those months?

Also, examine the months where progress stalled. Were there specific expenses like life insurance premiums or car repairs that got in the way?

This kind of analysis helps you optimize your approach over time. You become smarter about where your money goes and how to accelerate your payoff.

You might find that you have a unique financial opportunity to pay a lump sum. Your tracker will help you decide the best place to apply it.

Conclusion

Learning how to track your debt payoff progress isn’t just about spreadsheets and apps. It’s about creating visibility into your financial journey.

When you can see exactly where you are and how far you’ve come, everything changes. Those numbers become proof that you’re making real progress, not just hoping for it.

Start simple with whatever method feels most comfortable. Update it regularly and celebrate your wins along the way.

The path out of debt becomes so much clearer when you know how to track your debt payoff progress effectively. You’ve got this, one payment at a time.

The sooner you take action on your debt, the more you’ll save. Start with Simple Debt Solutions and compare real offers today — so you can finally move forward with confidence.